September 30 2025

Unaudited Operating Performance and Key Highlights 1 :

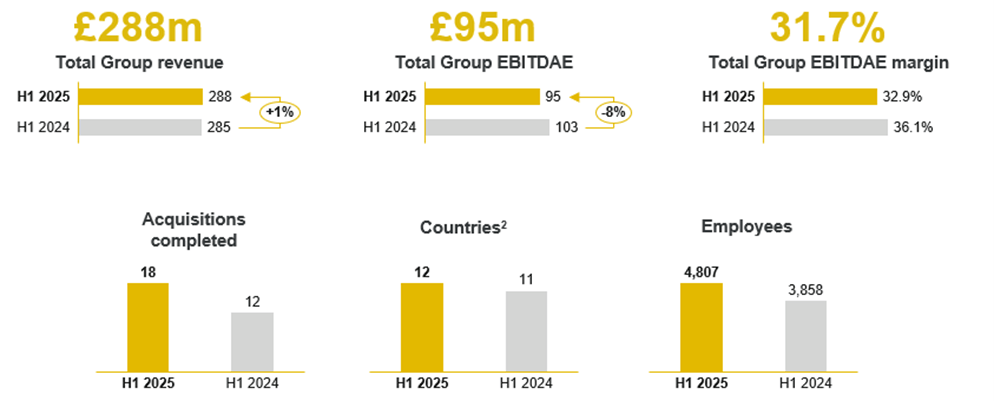

- Organic revenue growth of 1%, underpinned by strong performance in UK & Ireland advisory, and continued growth across key European Advisory markets – notably Spain, Germany and Poland.

- Total Group EBITDAE declined year-on-year as revenue growth across most divisions was offset by higher staffing and IT costs. Execution of the target operating model initiative has resumed after being delayed in H1 2025 and is expected to drive margin improvement in 2026.

- New market entry in Portugal in 2025 and an additional 6 acquisitions since June 2025.

1. Refer to page 40 of the PIB Group Annual Report and Financial Statements for the Year ended 31 December 2024 for the Alternative Performance Measures

2. Countries include all trading entities and branch locations

M&A Update:

In the first half of 2025, The Group successfully completed eighteen acquisitions, furthering the growth momentum established in prior years. This includes four acquisitions in Spain and one acquisition in Portugal, significantly enhancing The Group’s presence in Europe and reinforcing its vision to become a leading and dominant player in both the UK and European insurance brokerage market.

During the first half of the year The Group has made the following acquisitions:

- Group Fresse – Commercial Insurance Broker in France

- Thoma – Commercial Insurance Broker in Netherlands

- John O’Donohue Insurance Ltd – Commercial Insurance Broker in Ireland

- Transbrokers - Commercial Insurance Broker in Poland

- Residents Line Limited – Commercial Insurance Broker in United Kingdom

- Elleti Broker – Commercial Insurance Broker in Italy

- GM portfolio – Commercial Insurance Broker in Poland

- Litica – MGA in United Kingdom

- Insurance 4 Group ta Therapist Insurance – Commercial Insurance Broker in United Kingdom

- Amba People Limited – Employee Benefits Insurance Broker in United Kingdom

- Fincon – Reinsurance Broker in Poland

- Blansegur – Commercial Insurance Broker in Spain

- Schippers – Commercial Insurance Broker in Spain

- RCU – Motor Insurance Broker in Poland

- Feast Noble – Commercial Insurance Broker in United Kingdom

- Vitorinos – Commercial Insurance Broker in Portugal*

- Seguros Torres – Commercial Insurance Broker in Spain*

- Alba- Vera – Commercial Insurance Broker*

*Completed acquisitions in H1 2025, not onboarded into financial results

Capital Management:

The Group aims to maintain an affordable and efficient level of debt aligned with our target leverage, interest cover, debt maturity profile, and sustainable capital structure. The current debt facilities and utilisation as of 30 June 2025 are summarised in the table below:

| Facility | Original Facility size (£’m) | Facility Amount Outstanding (£’m) | Unutilised Facility Amount (£’m) | Maturity Date |

| B3 | 1,170 | 1,170 | - | May-2031 |

| PIK | 275 | 316 | 0 | Mar-2033 |

| ACF4 | 300 | 307 | 0 | May-2031 |

| ACF5 | 400 | 0 | 400 | May -2031 |

| RCF | 161 | 60 | 101 | Nov-2030 |

| Total | 2,308 | 1,853 | 501 |

|

PIB Group Chief Financial Officer; David Winkett commented: